what is wealth?

Wealth is not merely measured in the size of your bank account or the opulence of your possessions; it encompasses a broader spectrum that includes emotional richness, time freedom, and meaningful relationships. As we navigate through this multifaceted topic, we’ll unravel the layers of what it truly means to be wealthy in today’s society.

Poverty and wealth

In a world that often celebrates the glittering heights of wealth, it is easy to overlook the shadowy depths of poverty that persist just out of sight. Imagine walking through a bustling city, where shimmering skyscrapers cast long shadows over dilapidated neighborhoods—each step revealing an unsettling contrast between opulence and deprivation. This juxtaposition is not merely a backdrop; it is a stark reminder of society’s most pressing challenges. Wealth and poverty are two sides of the same coin, intricately linked yet profoundly different in experience and opportunity.

how we change our life with money

When we think about changing our lives with money, the focus often shifts toward accumulation and material wealth. However, true transformation occurs when we shift our mindset from mere spending to strategic investment in experiences that enrich our well-being. Instead of a new car or lavish vacation, consider how funds directed toward personal development—like courses or workshops—can unlock potential and open doors previously thought inaccessible. Investing in skills not only enhances our professional standing but also nurtures a profound sense of self-worth and purpose

7 realistic steps to build your wealth today;

- 2. Start Saving Immediately

- 3. Prioritize Debt Management

- 4. Increase Your Income

- 5. Build an Investment Strategy

- 6. Plan for Emergencies

- 7. Get Financial Advice

1. Create a Personalized Financial Plan

Let’s get real about building wealth: it starts with a plan, your blueprint for the rich life you’re aiming for. Forget cookie-cutter advice; this is about what wealth means to you. Is it freedom from debt, a swanky apartment, or maybe a nest egg that lets you retire at 50?

Setting Goals with Real Grit

Your financial plan needs to be as unique as your fingerprint. Start with clear goals – both short-term (like squashing credit card debt) and long-term (like owning a beach house). Be specific. Instead of saying, “I want to save more“, commit to an exact number each month. This isn’t wishful thinking; it’s about setting real, achievable targets.

Adjust the Financial Plan as You Grow

Life throws curveballs, and your financial plan should be ready to catch them. Got a raise? Awesome – now tweak your savings plan. Had a surprise expense? Time to adjust. Regular check-ins on your financial plan keep it alive and kicking.

Keep It Simple, Make It Big

Here’s the thing – your financial plan shouldn’t be a novel. Keep it simple, straightforward, and action-oriented. The best plans are those you can stick to without falling asleep. So, write it down, and make it exciting. A financial plan isn’t just about managing money; it’s about turning your dreams into achievable goals.

2. Start Saving Immediately

When it comes to building wealth, there’s one golden rule: start saving, and start now. Time is your ally in the game of wealth-building, thanks to the magic of compound interest. The sooner you start, the more your money grows. Think of each dollar saved today as an employee working tirelessly to make you richer.

Saving Isn’t Just for the Future

Don’t fall into the trap of thinking saving is only for ‘future you.’ Sure, it’s about retirement and big life goals, but it’s also about creating a buffer for the unexpected and giving present ‘you’ peace of mind. Start with whatever you can – even a small amount saved consistently can snowball into a significant sum over time.

The Art of Automating Savings

Make saving a no-brainer. Set up automatic transfers to your savings account each payday. It’s like putting your wealth-building on autopilot. You’ll be surprised how quickly these automatic contributions add up, and you won’t even miss the money.

3. Prioritize Debt Management

Let’s face it – debt is the equivalent of financial quicksand. Managing, reducing, or avoiding it should be at the top of your wealth-building strategy. Why? Because every dollar you pay in interest is a dollar not growing in your savings or investments. It’s not just about numbers; it’s about freedom – the freedom from financial burdens that hold you back from building real wealth.

Tackling Debt Strategically

While some debt might be necessary (like mortgages or student loans), the key is to handle it wisely. Start by attacking high-interest debts, such as credit card balances. These are the real wealth killers, silently eating away at your financial health. Paying them off quickly isn’t just about saving on interest; it’s about reclaiming your income.

Have a Plan to Crush Debt

Set up a debt repayment plan that works for you. It might be the debt avalanche method, where you pay off debts with the highest interest rate first, or the debt snowball method, where you start with the smallest debts for quick wins. Whichever method you choose, stay committed. Automate your payments if possible, and if you get extra cash – a bonus, tax refund, or a side hustle income – consider putting it towards your debt.

4. Increase Your Income

Boosting your income is like adding rocket fuel to your wealth-building journey. Start where you are – your current job. Are there opportunities to climb up the ladder? Don’t shy away from negotiating a raise if you believe you’ve earned it. Back up your request with achievements and market research. Sometimes, the simplest way to earn more is just to ask.

Exploring New Opportunities

If you’ve hit a ceiling in your current role, it might be time to look elsewhere. Scope out positions in your industry that offer better pay and growth prospects. Remember, switching jobs is one of the fastest ways to increase your income.

Skill Up to Level Up

Invest in yourself. Acquiring new skills or certifications can make you more valuable in the marketplace. Whether it’s an online course or a full-blown degree, education is an investment with a high return potential.

The Side Hustle Route

Now, let’s talk about side hustles. In today’s gig economy, the possibilities are endless. From freelance writing to driving for a rideshare service, find something that aligns with your skills and schedule. You won’t only be getting some extra cash, but diversifying your income sources too. And if you don’t know where to start, we got you – check out my article on 50+ Best Side Hustle Ideas To Make Money Fast .

5. Build an Investment Strategy

Building wealth is much more than saving money – it’s about making your money work for you. That’s where a solid investment strategy comes into play. Investing is your ticket to compound growth – it’s how you turn your savings into a growing wealth pool.

The Golden Rule of Diversification

The cornerstone of any savvy investment strategy is diversification. It’s like the old saying, “Don’t put all your eggs in one basket“. Spread your investments across different asset classes – stocks, bonds, real estate, or even emerging opportunities like cryptocurrencies. Diversification reduces risk; if one investment dips, others in your portfolio can balance it out.

Staying Informed, Not Reactive

Investing isn’t a set-it-and-forget-it deal. Stay informed about market trends and adjust your strategy as needed, but avoid knee-jerk reactions to short-term market fluctuations. Be patient, stay committed to your strategy, and watch as your investments lay the groundwork for a richer future.

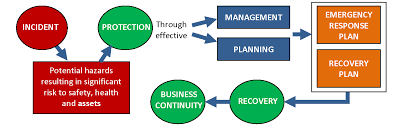

6. Plan for Emergencies

Life is full of surprises, and not all of them are pleasant. That’s why having an emergency plan is key to any wealth-building strategy. Think of it as your financial safety net, ready to catch you when the unexpected happens.

Building Your Emergency Fund

Start by building an emergency fund. A good rule of thumb is to have enough to cover three to six months of living expenses. This fund should be easily accessible, like in a savings account, but separate from your regular checking account to avoid temptation.

Insurance as a Protective Layer

In addition to savings, ensure you have appropriate insurance in place – health, life, disability, and property insurance can save you from financial ruin in case of accidents, illness, or other unforeseen events.

The Peace of Mind Factor

An emergency plan gives you peace of mind. Knowing you’re prepared for life’s curveballs lets you focus on your wealth-building efforts without the nagging fear of the unknown. It’s not just about protecting your finances; it’s about safeguarding your future plans and dreams.

7. Get Financial Advice

Building wealth is a journey, and sometimes, you need a guide. Seeking financial advice can provide clarity, direction, and a boost to your wealth-building efforts.

When to Seek Advice

Whether you’re just starting out, facing a complex financial situation, or looking to optimize your investment strategy, professional financial advice can be invaluable. A good financial advisor can help you make informed decisions, avoid costly mistakes, and tailor a plan that suits your unique financial situation and goals.

Investing in Your Financial Education

While professional advice is key, so is your financial literacy. Stay informed, ask questions, and understand the recommendations made by your advisor. After all, it’s your wealth, and you should be in the driver’s seat.

Start Your Journey to a Wealthier Life

As I always say, ‘The single most important factor to getting rich is getting started, not being the smartest person in the room.’ This isn’t just a catchy phrase; it’s the cornerstone of building wealth.

Every tip and strategy shared here, from crafting a savvy financial plan to embracing smart investing, hinges on this fundamental truth. It’s not about being a financial wizard or having all the answers upfront. It’s about making that first, bold move towards your goals.

CONCLUSION;

Building wealth is a journey that requires dedication, strategic planning, and a willingness to adapt. By following these seven realistic steps—setting clear financial goals, budgeting wisely, investing smartly, diversifying income streams, continuously educating yourself, networking effectively, and maintaining discipline—you lay a solid foundation for lasting financial success. Remember that the path to riches is not an overnight endeavor; patience and persistence are key. Start implementing these strategies today to take control of your financial future. Take the first step now and commit to transforming your aspirations into reality!

FAQ:

How can I increase my income?

Explore avenues for career advancement, consider starting a side business, or invest in skills that are in high demand. Passive income streams, such as rental properties or dividend stocks, can also supplement your earnings.

What Are Common Mistakes People Make When Trying to Get Rich?

Common mistakes include not having a financial plan, living beyond their means, neglecting to invest, and letting emotions drive financial decisions. Avoid these pitfalls by planning, educating yourself, and seeking advice when needed.

How Important Is Debt Management in Getting Rich?

Very important. High-interest debt, like credit card debt, can erode your ability to save and invest. Prioritize paying off high-interest debts and manage other debts wisely to free up more money for wealth-building activities.

Getting rich is more about consistency and smart financial habits than about making a lot of money overnight. It’s a marathon, not a sprint.